In scenes reminiscent of the 2021 GameStop mania, shares of struggling plant-based meat company Beyond Meat have experienced one of the most volatile trading episodes in recent market history, surging over 1,300% in just days before crashing back down in dramatic fashion.

The wild ride, orchestrated by retail traders on social media platforms including Reddit's notorious WallStreetBets forum and X (formerly Twitter), saw the company's shares rocket from an all-time low of US$0.50 last Thursday to as high as US$7.69 on Wednesday, before giving back most of those gains to close down 1% on the day.

Meet the 'Roaring Kitty' of Beyond Meat

At the centre of the frenzy is Dubai-based trader Dimitri Semenikhin, who goes by the handle "Capybara Stocks" on social media. The 29-year-old trader revealed he had purchased approximately 3.1 million shares of Beyond Meat at an average price of US$0.78 on 14 October—representing roughly 4% of the company's float before a recent debt restructuring.

"Back at under a dollar, it was very clear to me the company was severely mis-priced and undervalued," Semenikhin told Reuters. "What is extremely surprising is the scale at which this has been happening and the speed and community engagement that this has formed."

Semenikhin has been compared to Keith "Roaring Kitty" Gill, the retail trader who became the face of the 2021 GameStop short squeeze and was even the subject of a 2023 film called "Dumb Money."

The Perfect Storm

Several factors converged to create what market observers have called "the classic meme cocktail":

Extreme short interest: Beyond Meat was one of the most shorted stocks in the US market, with short interest reaching 81.8% of its free float at one point, according to analytics firm Ortex. When heavily shorted stocks rise, short sellers are forced to buy shares to cover their positions, creating additional upward pressure—a phenomenon known as a short squeeze.

Meme ETF addition: On Monday, Beyond Meat was added to the Roundhill Meme Stock ETF, joining infamous names like GameStop and AMC Entertainment. The mechanical buying from the ETF helped trigger the initial surge.

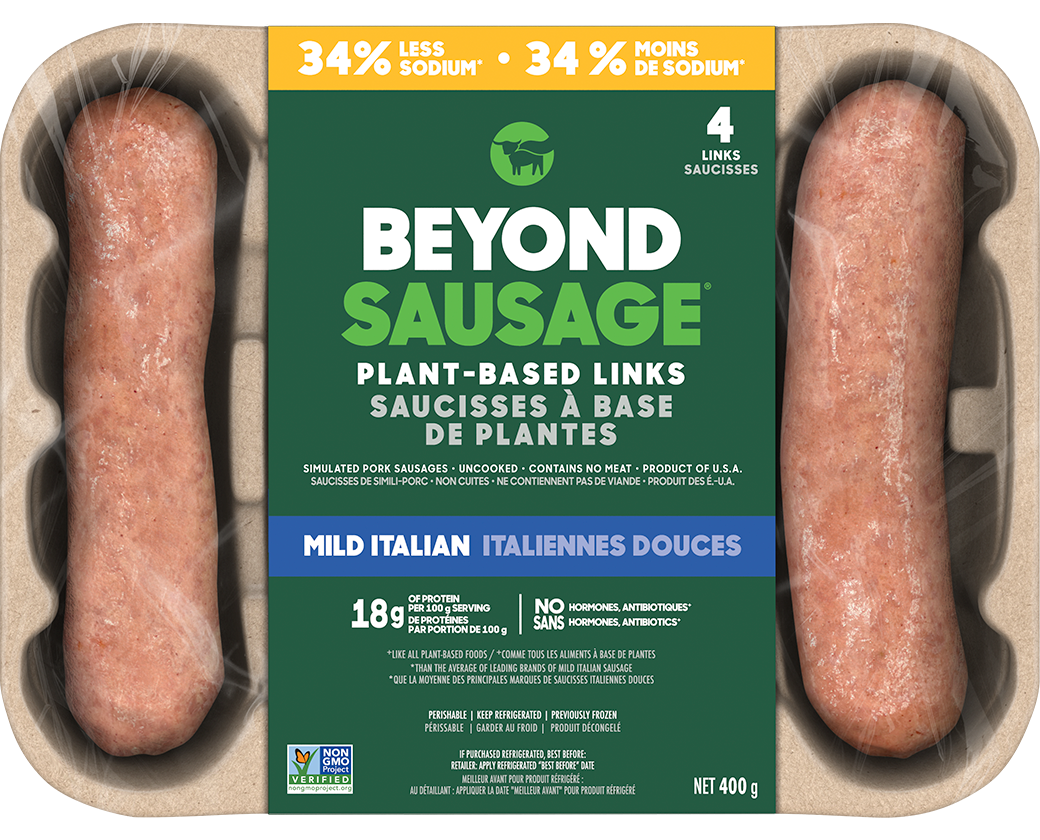

Walmart announcement: The company announced expanded distribution of its Beyond Burger 6-pack and Beyond Chicken Pieces to over 2,000 Walmart stores across the US, providing a legitimate business catalyst that gave retail traders a narrative to rally around.

Fresh liquidity: A recent debt restructuring that converted notes due in 2027 into new notes due in 2030, along with 316 million new shares, provided fresh liquidity for traders to exploit.

Reddit and X Drive the Mania

Posts on WallStreetBets and X called Beyond Meat "a symbol of rebellion" and urged the "retail army" to pile in. Trading volume exploded to 438 million shares on some days, compared to a typical daily average of 13 million.

"FULL PORTED MY LIFE SAVINGS INTO BYND," one Reddit user posted, with another replying: "EVERYONE INVEST YOUR LIFE SAVINGS RN."

Some users even pledged to go vegan if the stock hit certain price targets, while others drew explicit parallels to the 2021 meme stock frenzy.

The stock became one of the most viewed tickers on Yahoo Finance, with mentions across retail trading channels exploding into the hundreds.

The Reality Check

Despite the trading euphoria, market analysts and experts have issued stark warnings about Beyond Meat's fundamentals:

Deteriorating business: Revenue dropped 20% year-over-year in the second quarter to just US$75 million, falling short of expectations. The company has accumulated US$931 million in operating losses since 2021.

Massive dilution: The recent debt restructuring will issue up to 326 million new shares, massively diluting existing shareholders.

Near-bankruptcy: The debt-for-equity swap was widely seen as a desperate move to avoid default, with analysts noting the company would almost certainly have been unable to repay notes due in 2027.

Analyst consensus: Not a single one of the nine analysts covering Beyond Meat recommends buying the stock. The consensus rating is "Strong Sell," with a median 12-month price target of just US$3—and some firms even more pessimistic. TD Cowen recently lowered its target to US$0.80.

Delisting risk: Before the surge, the stock had fallen below the Nasdaq's US$1 minimum bid price requirement. While the rally temporarily pushed it back above that threshold, analysts warn it could easily slip back below if the meme-driven momentum fades.

From Darling to Disaster

Beyond Meat's spectacular fall from grace has been remarkable. The company went public in 2019 at a valuation of US$14 billion, with shares briefly hitting US$239. As of Wednesday, the company's market capitalisation sits at around US$1.4 billion—a 90% collapse from its peak, even after the recent surge.

The plant-based meat sector, once hailed as the future of food, has struggled as consumer demand plateaued. Competition has intensified, with traditional meat companies launching their own plant-based alternatives, while Beyond Meat has faced persistent questions about its pricing, taste, and long-term viability.

"Loss-making, heavily shorted, meme-able ticker and easy to understand, the classic meme cocktail," said Ivan Cosovic, managing director of Germany-based data group Breakout Point. "Whether this goes to infinity and BYND or just serves up another slice of fake-meat humble pie, retail is clearly having meme-fun again."

Extreme Volatility

The stock's movements have been nothing short of chaotic. On Wednesday alone, Nasdaq halted trading four times due to volatility. Pre-market trading saw gains of up to 112%, only for the stock to tumble 27% during regular hours before recovering slightly.

One source reported the stock had surged approximately 600% over three trading sessions from its low point, while another noted gains approaching 1,300% at the peak before the Wednesday selloff.

Echoes of 2021

The Beyond Meat saga has drawn inevitable comparisons to the 2021 meme stock phenomenon, when retail traders coordinating on Reddit drove up shares of GameStop, AMC Entertainment, and other heavily shorted companies, causing billions in losses for hedge funds.

The 2021 events even prompted congressional hearings and spawned new regulations around retail trading and social media-driven market movements.

Adding fuel to the Beyond Meat fire, controversial businessman Martin Shkreli—known as the "Pharma Bro"—publicly criticised the rally, which appeared to only energise the retail traders further.

"He just added fuel to the fire," one X user reacted. "Hey, retail, let's show him what time it is," another posted.

Other Meme Stocks Join the Party

Beyond Meat wasn't alone in the revival of meme stock mania. Krispy Kreme, the struggling doughnut maker, surged 30% on Wednesday as retail traders sought other heavily shorted, recognisable brand names. The Roundhill Meme Stock ETF itself advanced 5.3% on the day.

Analysts: Stay Away

Despite the social media hype, professional investors remain deeply sceptical.

"Buying BYND stock at current levels is more of a gamble since short squeezes can be fleeting, and retail-driven rallies often lack staying power," wrote analysts at Barchart. "Until Beyond Meat proves it can generate sustainable earnings, long-term investors may want to stay on the sidelines."

Jefferies analyst Kaumil Gajrawala described the company as "shrinking to survive" and said profitability remains a distant goal, with the firm targeting positive EBITDA only in the second half of 2026.

What's Next?

Whether Beyond Meat can sustain any of its gains—or whether it will follow the path of other meme stocks that briefly soared before crashing back to earth—remains to be seen.

Some retail traders are betting on continued volatility, with call option volume spiking 151% during the rally. However, as short sellers finish covering their positions and retail attention potentially shifts elsewhere, many market observers expect the stock to give back most or all of its gains.

For now, Beyond Meat stands as the latest symbol of the ongoing battle between retail investors armed with social media and traditional Wall Street short sellers—a reminder that in today's markets, viral attention can move share prices just as powerfully as business fundamentals, at least in the short term.

As one analyst put it: "This move is about flow and attention, not a sudden turnaround in the business. Big squeezes can go higher than anyone expects. They can also reverse in seconds."

Investment warning: This article is for informational purposes only and does not constitute investment advice. Meme stocks are highly volatile and risky investments. Past performance does not indicate future results.

With reporting from Reuters, Bloomberg, Business Insider and market data from Nasdaq, Ortex and Google Finance